Smart Choices, Better Health – Reviews You Can Trust

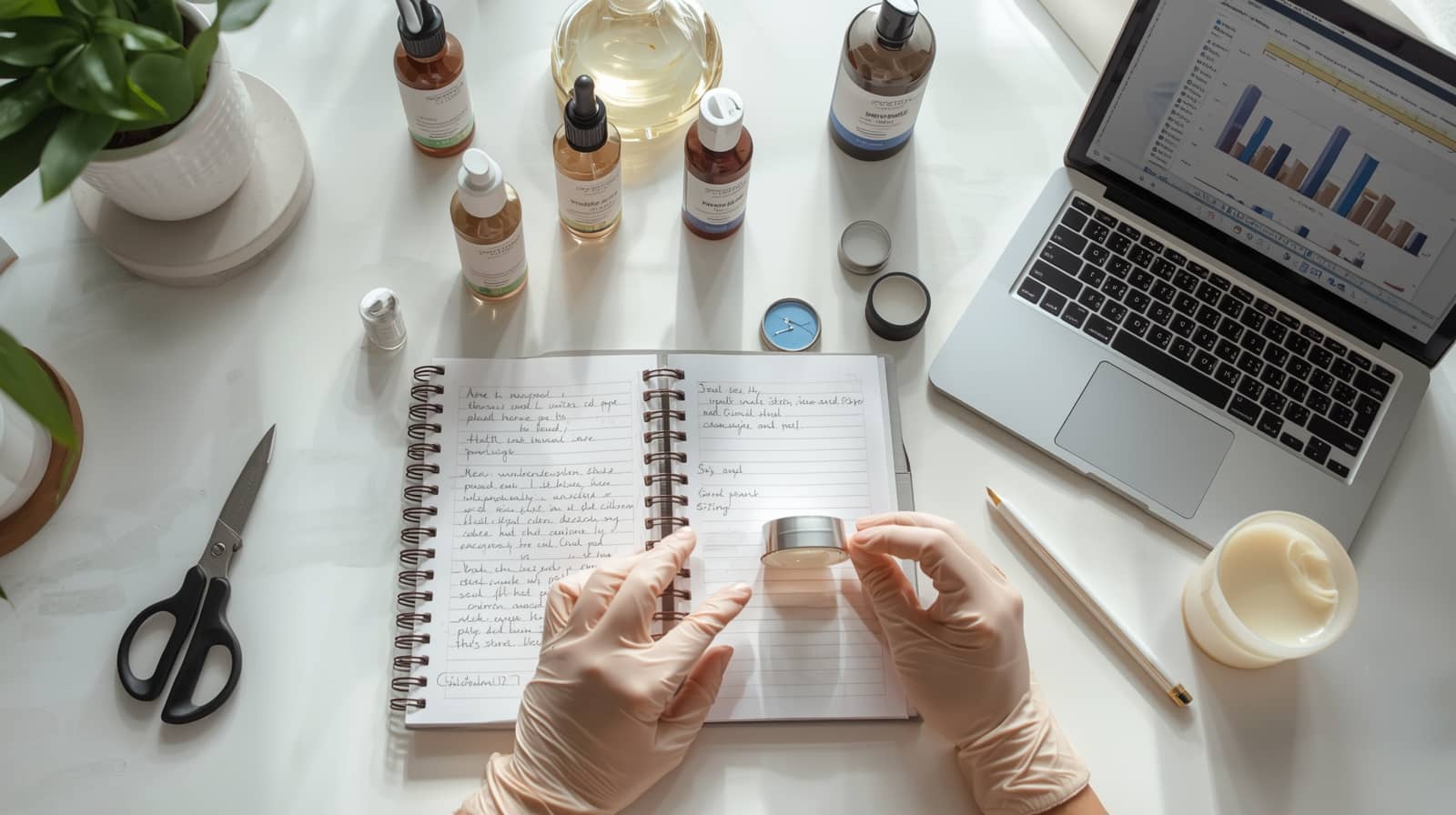

Welcome to CommunicationList.com, where honest product reviews meet genuine expertise. We’re dedicated to helping you navigate the overwhelming world of health and personal care products with confidence. Our team, led by experienced product specialist Babu and meticulous editor Towsif, rigorously tests and evaluates products to provide you with unbiased, comprehensive reviews. We understand that choosing the right health products impacts your wellbeing, which is why we invest countless hours in research, testing, and analysis. Unlike other review sites, our editorial independence means we’ll always tell you the truth, even when it means recommending against popular products. With over a decade of combined experience, we’re committed to being your trusted partner in making informed health and personal care decisions.

Start From HereExplore Our Categories

Browse through our collection

Over 10 years of experience

With over a decade of experience in health and personal care product research, CommunicationList.com has established itself as a trusted authority in the industry.

Our extensive background enables us to quickly identify quality products, recognize misleading marketing claims, and understand the nuances that distinguish effective solutions from ineffective ones. Throughout these years, we’ve tested hundreds of products across multiple categories, from skincare and supplements to fitness equipment and personal hygiene items.

This wealth of experience means we know what questions to ask, which factors matter most, and how to evaluate products comprehensively. Our seasoned perspective helps you avoid common purchasing mistakes and discover products that truly deliver on their promises.

Learn more

Tired of misleading product reviews and conflicting information? CommunicationList.com was created to solve exactly that problem. We’re a team of health enthusiasts and product testing experts who believe you deserve honest, reliable information when making health and personal care decisions. Our lead author Babu brings over 10 years of product research experience, while editor Towsif ensures every review meets the highest standards of accuracy. We personally test products, analyze scientific research, and evaluate real customer experiences to give you the complete picture. Our affiliate relationships never compromise our integrity – we’ve rated expensive products poorly and budget options highly because our loyalty is to you, our readers, not to manufacturers.

10 years of experience

Qualified personnel

Work to fit your timetable

Our Latest Post

best wet to dry hot air brush

best tourmaline hot air brush

best thermal hot air brush

best spon hot air brushe

best spiining hot air brush

best reviews on hot air brush

best hot air flat brush

best rechargeable hot air brush

best professional hot air brush

best hot air turning hair brush

best hot air rotating brush

best hot air brush for super short hair

best hot air brush for shoulder length hair

best hot air brush for fine straight hair

best hot air brush for curly hair straightening

Why choose us

Choose CommunicationList.com because we prioritize your trust above everything else. Unlike typical review sites, we maintain strict editorial independence, ensuring our assessments are never influenced by affiliate commissions.

Our team of experienced professionals, led by Babu and Towsif, employs rigorous testing methodologies that combine hands-on evaluation, scientific research, and verified customer feedback analysis. We don’t just repeat manufacturer claims – we dig deeper to uncover the truth about product effectiveness, safety, and value.

With over 10 years of combined experience in health product research, we provide comprehensive, honest reviews that help you make confident purchasing decisions. When you read our reviews, you’re getting expert insights focused solely on your best interests.

Learn more